In 2004, Slovakia adopted an innovative system of tax designation unlike any other in the world, where not only individuals but also corporations could divert a portion of their income tax to civil organizations.

The Summary

This pioneering system substantially changed the relationships among the NGOs, businesses, and the government. Besides the financial gain and proliferation of corporate foundations the mechanism helps strengthening partnerships between NGOs and businesses in achieving social impact.

Since its introduction in 2004, the corporate tax designations have become the subject of constant political concern, with accusations of tax evasion, as well as alleged misuse of the system in the PR, marketing, and retail business strategies of the parenting companies. To the detriment of many organizations, the model underwent changes during the financial crisis: the percentage was reduced in 2009, and the mechanism was simultaneously enriched with an incentive to enhance private giving (the matching principle). Nonetheless, in more than decade, the corporate tax designations have generated income for NGOs exceeding 300 million EUR.

In April 2015, the new agreement between Ministry of Finance and civil sector paved the way for the stability and higher transparency of the corporate tax designation mechanism.

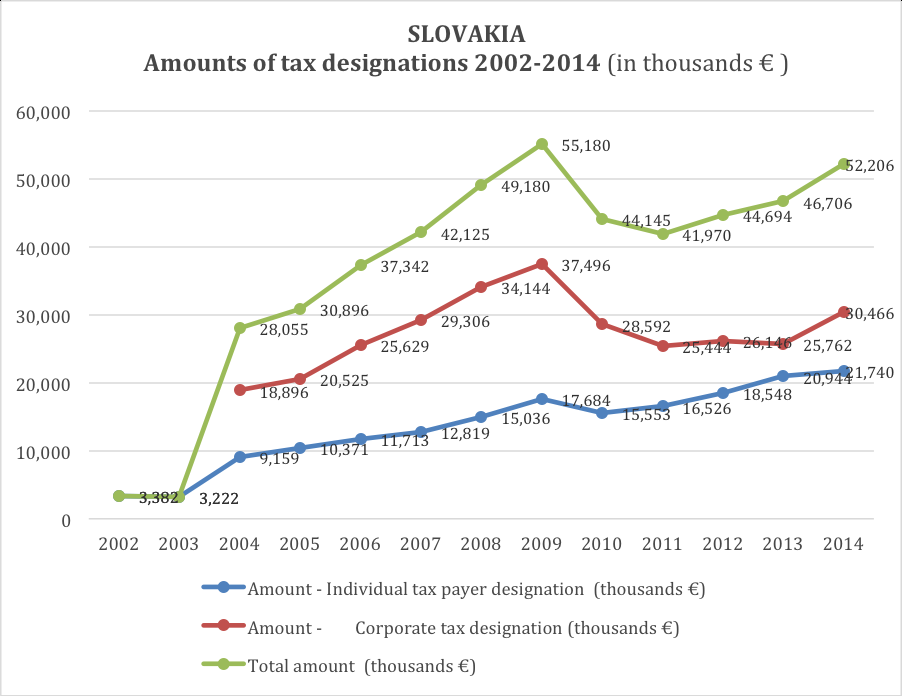

Source: The Institute for Financial Policy at the Ministry of Finance; The Financial Administration Office, Tax Administration Office

The Origins

In 2002, before the parliamentary elections in June, a decision was made to open the tax designation model to corporate entities, beginning in 2004. This diversion of a portion of corporate income tax to civil organizations made the Slovak version of the tax percentage system globally unique and interesting. Therefore, in this text we will deal with the corporate designation in more detail, noting first of all that revenues from corporate designations are almost double those from individual taxpayers.

The government introduced corporate tax designations in response to pressure from the non-profit sector to follow the example of the Czech Republic, which at the time used 1 % of its privatization revenues to fund Czech foundations. This proposal had not been accepted by the Slovak government, which instead had prepared a law extending tax designation to corporate taxpayers. Later in 2003, the percentage designation was increased to 2 %, so that in 2004, both changes came into practice at the same time.

The Evolution

Since its introduction, the system of designation by corporate bodies has undergone changes; not only is the mechanism a subject of constant political concern, but it substantially changes the overall philantropic environment, not to mention the relationships within the NGO sector. “For example, once it became available for corporate taxpayers, the number of foundations established by corporate entity started to grow. Between 1990 and 2001 only 23 corporate foundations were registered in Slovakia. Since 2002 to 2007 there were 58 new corporate foundations established. Many would bear the same name as the founder. In 2011, there are up to 90 corporate foundations that make 20% of all foundations.” (Strečanský, the Situation of the Third Sector in Slovakia, the Impacts, Trends, Mainstreams and Challenges 2012).

After 2004, about 60 new corporate foundations were established, due to the introduction of corporate designations. In particular, large companies – especially those in telecommunication, banking, or energy sector – allocate a huge proportion of the percentage designation to foundations that they themselves founded. Specifically, 12 corporate foundations were listed in the TOP 20 most successful recipients in 2014.

However, such a concentration of funds is counterbalanced by a strict requirement to spend tax designations by the end of the calendar year that follows receipt of the funds; this has steered the foundations into professional grant-making. In fact, corporate foundations have become some of the most relevant grant-making institutions in Slovakia, overtaking the position of the strong international donors that operated in Slovakia in the 1990s. Most tax designation funds in corporate foundations are being thoroughly spent through open grant-making programs.

Recently, the members of Association of corporate foundations that operate with big portions of the revenues from tax designation (half million Euro and more) adopted the Code of transparency deliberately obliging themselves to special online reporting on the use of tax designation revenues that goes far beyond the obligatory reporting standards. The Code obliges the foundations to publish detailed information through their websites on the issues of:

- Governance (e.g., list of the members of all organs, or CVs and profiles of employees etc.)

- Financial reports (e.g., structure of donations, or structure of expenditures, including information on spending the tax designation resources on running costs etc.)

- Grant-making (description of the selection process, or list of members of selection committees)

- Communication (e.g., obligation to answer each single request within 30 days).

The Arguments Against

The allocation of designations into corporate foundations led to a severe concentration of funds, which became one of the main subjects of critique from each Finance Minister, regardless of the political affiliation of the government. More specifically, these corporate foundations were sometimes branded as “oligarchic structures” (sic). Three major arguments against the corporate tax designation mechanism were raised by politicians in 2008:

a) corporations had evaded tax and misused the mechanism by designating corporate income tax to recipients with a minimum track record, non-existing public image, and zero transparency;

b) the mechanism had been misused in that corporate foundations had branded the projects they were supporting with the logo of their parent corporations, thus using public funds for private promotional and marketing activities;

c) in the austere environment of 2009, designating such a high portion of corporate tax revenue seemed fiscally unfeasible.

The principal changes

- In 2009 the government pushed through the gradual reduction of percentage for the corporate taxpayers. The “matching principle” was introduced.

In 2009 Finance Ministry labeled corporate tax designations as deterioration from the original goal of the system, which was to build relationships between CSO and individual taxpayers. The attempt to completely abolish the system for corporations was not successful, as the CSOs effectively mobilized broader public support with their campaign People for people. However, the percentage had been lowered to 1.5 % with prospects to gradually decrease on annual basis (down to 0.5 % in 2018). Besides reducing the percentage designation, the new amendment outlined incentives for businesses to engage with CSOs through direct financial support from their own profits; this was branded as the “matching principle” (corporate taxpayers who donated to a CSO from their own profits could designate a slightly higher percentage).

- In 2015 the new agreement between the Ministry of Finance and the CSO sector reversed the harmful changes of corporate tax designations made in 2009 and put forward a model that motivates corporations to donate even more.

The actual adjustments reinforce the “matching principle” of corporate tax designation mechanism, fixing the conditions as follows: if private donations from company profits exceed 0.5 % of corporate income tax, the company may designate 2 % of their income tax; otherwise, the tax designation percentage falls to 1 %.

- As of 2016 the tax designation providers (both groups) can opt to disclose their identity to beneficiaries (by marking the box in tax-return form).

The Battle

The first serious attempt to abolish the corporate tax designations appeared in 2006, when the then Finance Minister Jan Počiatek outlined several direct fiscal arguments, as well as some more refined criticism. Specifically, he labelled corporate tax designations a deterioration from the original goal of the system, which was to build relationships between NGOs and individual taxpayers. In so doing, he was attacking the corporate foundations, which had adopted the role of excess intermediaries. The attempt was not successful, as the NGOs effectively mobilized broader public support with their campaign Ľudia ľuďom (People for people); moreover, one of the government coalition partners (surprisingly by Vladimir Meciar), in a move intended to increase their political capital within the coalition rather than to strengthen civil society, took the side of the NGOs.

The highest revenue from corporate tax designation was collected in 2009, a year that also marked major changes in the tax percentage system. The government gradually reduced the percentage designation for corporate taxpayers, starting in 2010. Again, NGOs campaigned to maintain the 2 %; this time however, they only managed a compromise—a gradual reduction from 2 % to 0.5 % from 2011 to 2019. Besides reducing the percentage designation, the new amendment outlined incentives for businesses to engage with NGOs through direct financial support from their own profits; this was known as the matching principle.

The system was reconstructed to benefit corporate taxpayers who contributed to NGOs from their own profits. As of 2011, corporate taxpayers who had made private donations equivalent to 0.5 % or more of their tax could assign 2 %; otherwise, the designation was only 1.5 %. Therefore, the gradual decrease in the tax percentage between 2011 and 2019 was expected to be subsidized by an increase in private donations of up to 1.5 % of corporate taxes. However, this gradually decreasing model has never actually been enforced, as NGO leaders have successfully campaigned every year for its postponement.

This process came to a head in April 2015, when a new agreement – the Memorandum between the Ministry of Finance and the non-profit sector – reinforced the corporate tax percentage model, fixing the conditions as follows: if donations from company profits exceed 0.5 % of corporate income tax, the company may designate 2 % of their income tax; otherwise, the tax designation percentage falls to 1 %.

In this way, the philanthropic incentive for tax designation becomes more relevant. Further observation of how the new model works in practice could resolve the question of whether such tax designation incentives help to engage corporations in private philanthropy, as “the tax assignation was not seen as an optimal tool for enhancing this involvement.” (Kuvíková a Svidroňová 2014)

The Challenge

The greatest challenge for NGOs is to mobilize corporate taxpayers into private giving. An increase in this sphere would substantially raise total revenues in two ways: firstly, private donations would increase, and corporations could then apply to designate 2 % of their taxes. So far, only about 7 %–8 % of corporations with positive taxes have officially declared that their private donations match their designations. Interestingly, in 2013, the revenue of the NGO sector from private corporate donations was more than double (about 57 million EUR) the total revenue from corporate tax designations (25.7 million EUR), indicating that corporations partake in philanthropy without declaring it along with their tax designations.

The story of corporate tax designation in Slovakia

In 2004, Slovakia adopted an innovative system of tax designation unlike any other in the world, where not only individuals but also corporations could divert a portion of their income tax to civil organizations.

The Summary

This pioneering system substantially changed the relationships among the NGOs, businesses, and the government. Besides the financial gain and proliferation of corporate foundations the mechanism helps strengthening partnerships between NGOs and businesses in achieving social impact.

Since its introduction in 2004, the corporate tax designations have become the subject of constant political concern, with accusations of tax evasion, as well as alleged misuse of the system in the PR, marketing, and retail business strategies of the parenting companies. To the detriment of many organizations, the model underwent changes during the financial crisis: the percentage was reduced in 2009, and the mechanism was simultaneously enriched with an incentive to enhance private giving (the matching principle). Nonetheless, in more than decade, the corporate tax designations have generated income for NGOs exceeding 300 million EUR.

In April 2015, the new agreement between Ministry of Finance and civil sector paved the way for the stability and higher transparency of the corporate tax designation mechanism.

Source: The Institute for Financial Policy at the Ministry of Finance; The Financial Administration Office, Tax Administration Office

The Origins

In 2002, before the parliamentary elections in June, a decision was made to open the tax designation model to corporate entities, beginning in 2004. This diversion of a portion of corporate income tax to civil organizations made the Slovak version of the tax percentage system globally unique and interesting. Therefore, in this text we will deal with the corporate designation in more detail, noting first of all that revenues from corporate designations are almost double those from individual taxpayers.

The government introduced corporate tax designations in response to pressure from the non-profit sector to follow the example of the Czech Republic, which at the time used 1 % of its privatization revenues to fund Czech foundations. This proposal had not been accepted by the Slovak government, which instead had prepared a law extending tax designation to corporate taxpayers. Later in 2003, the percentage designation was increased to 2 %, so that in 2004, both changes came into practice at the same time.

The Evolution

Since its introduction, the system of designation by corporate bodies has undergone changes; not only is the mechanism a subject of constant political concern, but it substantially changes the overall philantropic environment, not to mention the relationships within the NGO sector. “For example, once it became available for corporate taxpayers, the number of foundations established by corporate entity started to grow. Between 1990 and 2001 only 23 corporate foundations were registered in Slovakia. Since 2002 to 2007 there were 58 new corporate foundations established. Many would bear the same name as the founder. In 2011, there are up to 90 corporate foundations that make 20% of all foundations.” (Strečanský, the Situation of the Third Sector in Slovakia, the Impacts, Trends, Mainstreams and Challenges 2012).

After 2004, about 60 new corporate foundations were established, due to the introduction of corporate designations. In particular, large companies – especially those in telecommunication, banking, or energy sector – allocate a huge proportion of the percentage designation to foundations that they themselves founded. Specifically, 12 corporate foundations were listed in the TOP 20 most successful recipients in 2014.

However, such a concentration of funds is counterbalanced by a strict requirement to spend tax designations by the end of the calendar year that follows receipt of the funds; this has steered the foundations into professional grant-making. In fact, corporate foundations have become some of the most relevant grant-making institutions in Slovakia, overtaking the position of the strong international donors that operated in Slovakia in the 1990s. Most tax designation funds in corporate foundations are being thoroughly spent through open grant-making programs.

Recently, the members of Association of corporate foundations that operate with big portions of the revenues from tax designation (half million Euro and more) adopted the Code of transparency deliberately obliging themselves to special online reporting on the use of tax designation revenues that goes far beyond the obligatory reporting standards. The Code obliges the foundations to publish detailed information through their websites on the issues of:

The Arguments Against

The allocation of designations into corporate foundations led to a severe concentration of funds, which became one of the main subjects of critique from each Finance Minister, regardless of the political affiliation of the government. More specifically, these corporate foundations were sometimes branded as “oligarchic structures” (sic). Three major arguments against the corporate tax designation mechanism were raised by politicians in 2008:

a) corporations had evaded tax and misused the mechanism by designating corporate income tax to recipients with a minimum track record, non-existing public image, and zero transparency;

b) the mechanism had been misused in that corporate foundations had branded the projects they were supporting with the logo of their parent corporations, thus using public funds for private promotional and marketing activities;

c) in the austere environment of 2009, designating such a high portion of corporate tax revenue seemed fiscally unfeasible.

The principal changes

In 2009 Finance Ministry labeled corporate tax designations as deterioration from the original goal of the system, which was to build relationships between CSO and individual taxpayers. The attempt to completely abolish the system for corporations was not successful, as the CSOs effectively mobilized broader public support with their campaign People for people. However, the percentage had been lowered to 1.5 % with prospects to gradually decrease on annual basis (down to 0.5 % in 2018). Besides reducing the percentage designation, the new amendment outlined incentives for businesses to engage with CSOs through direct financial support from their own profits; this was branded as the “matching principle” (corporate taxpayers who donated to a CSO from their own profits could designate a slightly higher percentage).

The actual adjustments reinforce the “matching principle” of corporate tax designation mechanism, fixing the conditions as follows: if private donations from company profits exceed 0.5 % of corporate income tax, the company may designate 2 % of their income tax; otherwise, the tax designation percentage falls to 1 %.

The Battle

The first serious attempt to abolish the corporate tax designations appeared in 2006, when the then Finance Minister Jan Počiatek outlined several direct fiscal arguments, as well as some more refined criticism. Specifically, he labelled corporate tax designations a deterioration from the original goal of the system, which was to build relationships between NGOs and individual taxpayers. In so doing, he was attacking the corporate foundations, which had adopted the role of excess intermediaries. The attempt was not successful, as the NGOs effectively mobilized broader public support with their campaign Ľudia ľuďom (People for people); moreover, one of the government coalition partners (surprisingly by Vladimir Meciar), in a move intended to increase their political capital within the coalition rather than to strengthen civil society, took the side of the NGOs.

The highest revenue from corporate tax designation was collected in 2009, a year that also marked major changes in the tax percentage system. The government gradually reduced the percentage designation for corporate taxpayers, starting in 2010. Again, NGOs campaigned to maintain the 2 %; this time however, they only managed a compromise—a gradual reduction from 2 % to 0.5 % from 2011 to 2019. Besides reducing the percentage designation, the new amendment outlined incentives for businesses to engage with NGOs through direct financial support from their own profits; this was known as the matching principle.

The system was reconstructed to benefit corporate taxpayers who contributed to NGOs from their own profits. As of 2011, corporate taxpayers who had made private donations equivalent to 0.5 % or more of their tax could assign 2 %; otherwise, the designation was only 1.5 %. Therefore, the gradual decrease in the tax percentage between 2011 and 2019 was expected to be subsidized by an increase in private donations of up to 1.5 % of corporate taxes. However, this gradually decreasing model has never actually been enforced, as NGO leaders have successfully campaigned every year for its postponement.

This process came to a head in April 2015, when a new agreement – the Memorandum between the Ministry of Finance and the non-profit sector – reinforced the corporate tax percentage model, fixing the conditions as follows: if donations from company profits exceed 0.5 % of corporate income tax, the company may designate 2 % of their income tax; otherwise, the tax designation percentage falls to 1 %.

In this way, the philanthropic incentive for tax designation becomes more relevant. Further observation of how the new model works in practice could resolve the question of whether such tax designation incentives help to engage corporations in private philanthropy, as “the tax assignation was not seen as an optimal tool for enhancing this involvement.” (Kuvíková a Svidroňová 2014)

The Challenge

The greatest challenge for NGOs is to mobilize corporate taxpayers into private giving. An increase in this sphere would substantially raise total revenues in two ways: firstly, private donations would increase, and corporations could then apply to designate 2 % of their taxes. So far, only about 7 %–8 % of corporations with positive taxes have officially declared that their private donations match their designations. Interestingly, in 2013, the revenue of the NGO sector from private corporate donations was more than double (about 57 million EUR) the total revenue from corporate tax designations (25.7 million EUR), indicating that corporations partake in philanthropy without declaring it along with their tax designations.